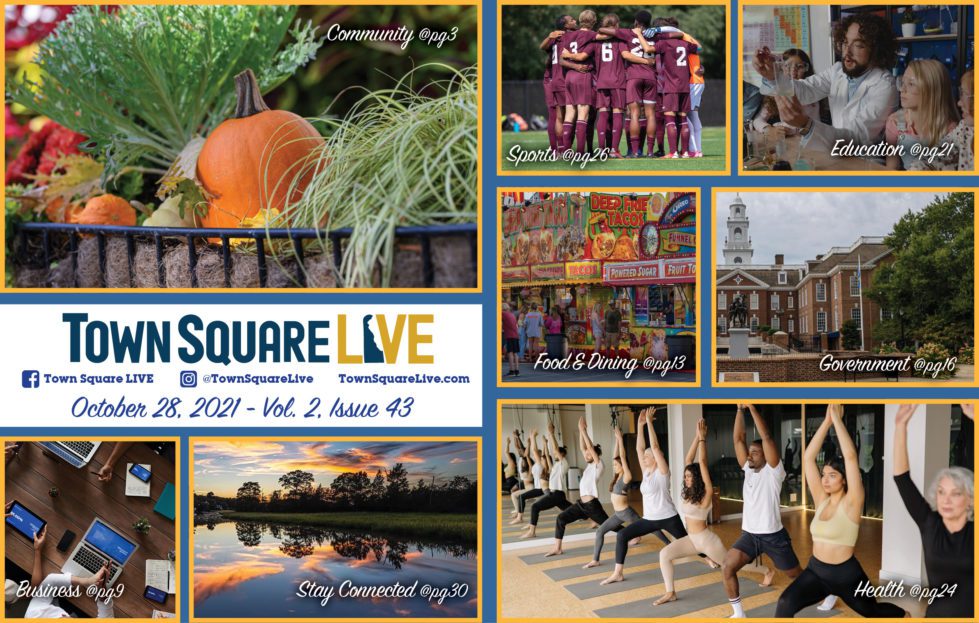

Hover over the image below and a gray bar pops up at the bottom—scroll through the pdf, use direction arrows, zoom in or out, download the PDF, or view in full-screen mode.

[pdf-embedder url=”https://townsquaredelaware.com/wp-content/uploads/2021/10/TSD-Oct-28.pdf” title=”TSD Oct 28″]This Week’s Top Headlines Include:

COMMUNITY

Juneteenth joins Thanksgiving, MLK Day as official state holiday

Faithful Friends breaks ground on 18,000-square-foot facility

St. Mark’s to honor fallen student, Veterans with 20K challenge

Flood damage causes Alapocas Run walking bridge to close indefinitely

Highlands Halloween parade, party at art museum

BUSINESS

Restaurants hardest hit by supply chain issues, Delaware experts say

Med tech company will use $2.2 million in Delaware grants to expand

Salvation Army beam raising marks start of Riverfront East development

FOOD

Home Appetit joins Full Circle Food to deliver meals in New Castle County

DART sets Thanksgiving ‘Stuff the Bus’ for Nov. 8-13

GOVERNMENT

Our (other) guy in the White House talks Afghan resettlement

State Reps ask Carney to remove auditor, but it seems unlikely

Delaware Senate publishes final proposed redistricting maps

Facing criminal charges, Darius Brown to lead expungement workshops

EDUCATION

Governor appoints Bridgeville student to State Board of Education

Teens aging out of foster system to get free college tuition

HEALTH

Booster shots OK’d for all vaccine brands, and they can be mixed

SPORTS

Blue Coats ditch Caesar Rodney logo in favor of nondescript horse

3 games to raise money for Childhood Cancer fight

Caravel hands Quakers first loss of the season

Share this Post