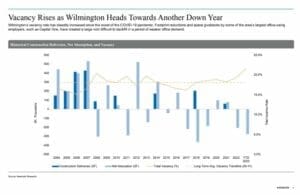

Wilmington’s downtown office vacancy rate has steadily increased since the onset of the pandemic.

Weaker demand for Wilmington office space coupled with rising interest rates and continuing corporate cost-cutting efforts is painting a dismal picture for the immediate future, according to a new 3Q 2023 Office Market Overview by Newmark.

“Chief financial officers are looking at their remote and hybrid workers and thinking they can cut costs by downsizing,” said Newmark Senior Managing Director Wills Elliman.

Downtown’s vacancy rate of 31.3% particularly shocked him when he first reviewed the raw data, he said.

“But are they cutting costs at the expense of the culture and soul of the firm? How do you advance in your career if you never see people – except behind a screen?” Elliman said. “There’s so much good about an office – conversation, collaboration, and collegiality – that’s being lost.

“One of the reasons we’ll go back to the office is especially young people… they’re worried about their jobs. They have FOMAP: Fear Of Missing A Promotion.”

Elliman said the Wilmington Central Business District Class A market having 1.4 million square feet of available office space against a base of 4.6 million square feet base is completely out of bounds for where a normal office market should be.

“You normally see vacancy rates in the low teens when a market is in balance and landlords can gamble with concessions such as free rent and tenant improvements to entice tenants,” Elliman said.

“Landlords would love to have you but the rising costs to upfit the space and higher interest rates can push rates from the mid-$20s to the mid-$30s” per square foot to make deals pencil out.

Wilmington’s downtown vacancy rate has steadily increased since the onset of the pandemic.

Other statistics from the report include:

- Wilmington South (New Castle, Bear, Glasgow, Newark, etc.) had the biggest block of vacant space in the Wilmington MSA at 739,000 square feet.

- Wilmington West (Greenville, Hockessin, Pike Creek, etc.) had the lowest vacancy rate at 6.8%.

- Wilmington North (Highlands through Claymont) had the highest average Class A average asking rent at $31.33, compared with the lowest Class A rate vs the lowest in Wilmington South at $23.36 per square foot.

Office space givebacks

Footprint reductions and space givebacks by some of the area’s largest office-using employers such as Capital One have created a large void difficult to backfill in a period of weaker office demand.

There has only been one lease over 100,000 square feet completed in the past five years in downtown – and that was the renewal for a law firm with 133,000 square feet. Therefore, there was no associated absorption.

Absorption is the rate at which commercial space is sold, leased or vacated over a specific period in a given market, described as positive or negative.

While that was happening, eight vacant blocks of space of at least 80,000 square feet were added to the downtown inventory. Those eight blocks combine to total more than 1.2 MSF of negative absorption.

Elliman predicted the fourth-quarter numbers won’t be any better than the third quarter, with no signs of a tenant coming in and taking a big block of space.

The report includes downtown Wilmington and much of New Castle County. Elliman says the suburban market is more robust.

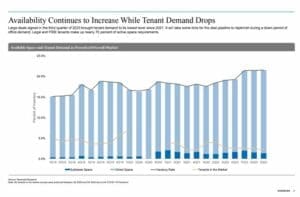

It will take some time for the deal pipeline to replenish during a down period of office demand, Elliman said

Legal and financial, insurance and real estate tenants tenants make up nearly 70% of active space requirements.

New office-space deliveries continue while new construction slows, and the construction pipeline remained unchanged compared to last quarter.

Current market fundamentals suggest the market is oversupplied. However, demand for newer space still exists, the Newmark report says.

Elliman added that the vacancy rate for offices built in the past 20 years is only 11.5%. Additionally, YTD absorption for modern buildings is 28,539 square feet.

The 12-story tower at Avenue North being built by Delle Donne & Associates at the former AstraZeneca campus in north Wilmington headlines the construction pipeline that includes 800 Creek View Road in Newark, the Walkers Mill Building in Wilmington, and continuing growth of the STAR campus near the University of Delaware.

The Avenue North project calls for 12 new buildings, 360 new apartments, four new streets, premium retail space, and 10.5 acres of open space.

NEW EATERY: Here’s what to expect at The Brandywine Restaurant, opening next week

Elliman said part of that is due to rising concession packages as owners put huge amounts into their space to close deals.

“We’ve seen people do deals that were actually loss leaders to drive other future deals,” he said.

Tenant efforts to sublet their office space has seen lower demand than other markets in Greater Philadelphia, with rates dropping by 13.1% over the past year due either to a decision that getting something is better than getting nothing or lease terms expiring, Elliman said.

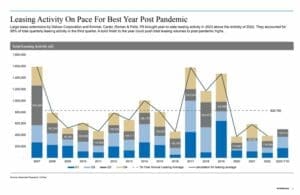

Still, GOLO’s new HQ lease for 22,000 square feet and the lease extensions in the third quarter by the Kimmel Carter law firm in Christiana and Deluxe Corp., a payments and business technology company, at the STAR campus, brought year-to-date leasing activity to a higher level than all of 2022, the Newmark report said.

Newmark, a leading commercial real estate adviser and service provider to large institutional investors, global corporations, and other owners and occupiers, is headquartered in New York with one of its 170 offices worldwide in Wilmington.

Peter Osborne is a freelance journalist and former editor of the Delaware Business Times. Contact him at [email protected].

Share this Post