The town of Smyrna has a multimillion dollar budget deficit that it will try to combat by raising the taxes of local residents.

Sheldon Hudson, town manager, said the Smyrna Town Council originally thought the deficit would be $8 million, but the Budget Committee has since clarified that it has shrunk to the tune of about $6 million, $2 million less than the initial estimate

Smyrna is in a unique position in that its fiscal year aligns with the calendar year, so it is currently operating in a deficit for the 2024 year.

The state government, and most towns, have a fiscal year that runs from July 1 to June 30 of the next year.

So the state, for example, starts fiscal year 2025 July 1 of this year, with it ending June 30 of 2025.

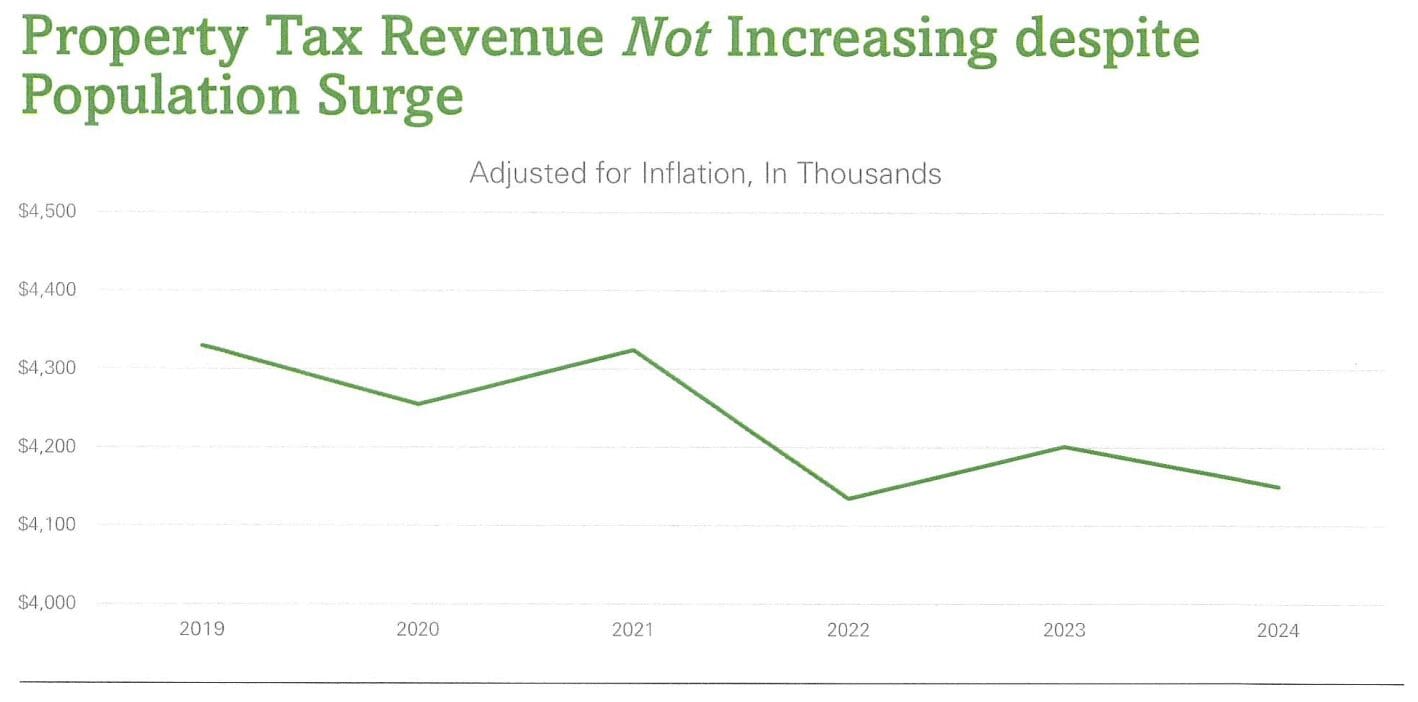

One reason for the deficit is the town’s population has increased 21% since 2019, yet the tax revenue has remained the same.

Smyrna has a population of roughly 14,250 as opposed to about 11,800 in 2019.

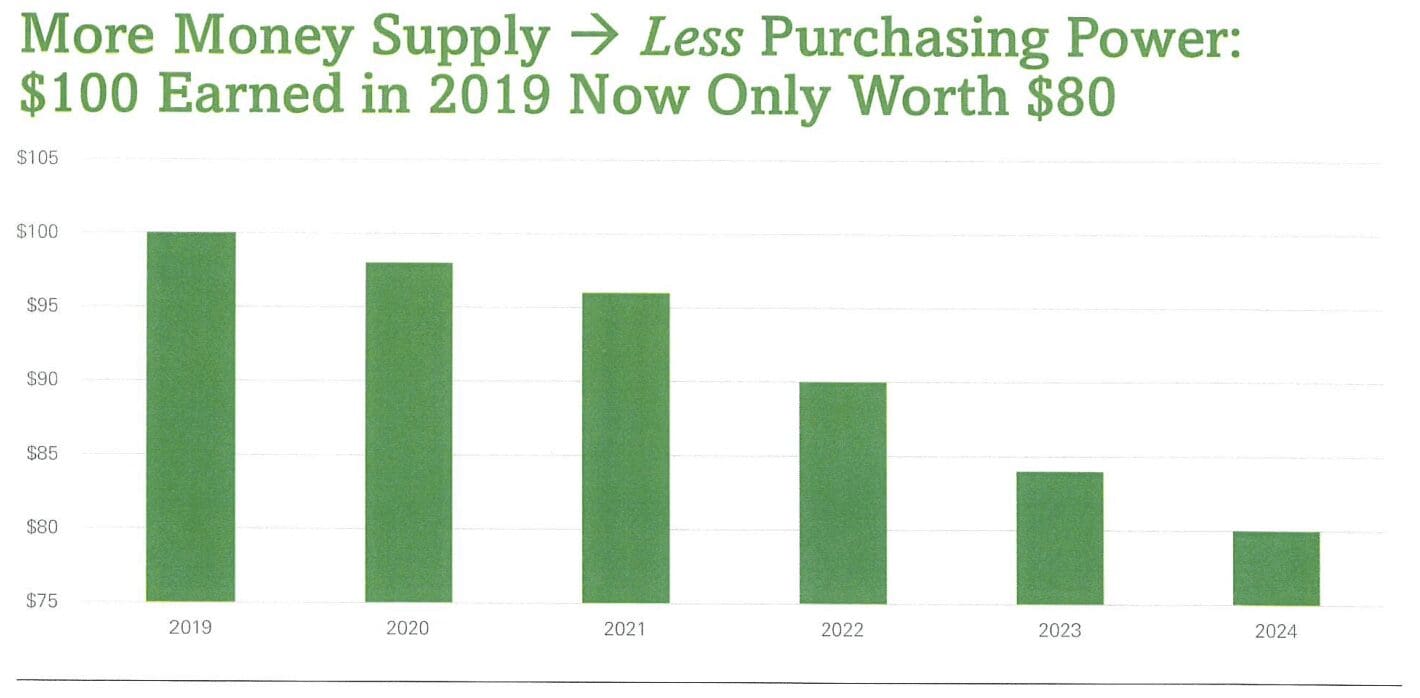

Additionally, Hudson pointed out the booming inflation that has seemingly affected every industry and individual in the country.

This creates less purchasing power, he said, adding that $100 in 2019 is worth $80 today.

“It’s probably unavoidable not to have some sort of meaningful tax and utility rate increases to account for that, but we’re also trying to look at what we can do in terms of cuts,” Hudson said. “We’re trying to take a balanced approach.”

There’s been a persistent lagging of keeping up with inflation over the past couple of decades, he said, which has compounded to the point of this year’s budget deficit.

The town’s operating budget is about $40 million.

And while there might have been some small deficits over the years, Hudson said to his knowledge there hasn’t been a deficit of this magnitude “in quite some time.”

The average resident in Smyrna pays a local tax of 47 cents per $100 of assessed property value.

“We’re calculating now, and this is kind of a worst case scenario, but around $20 per year per penny,” he said. “So let’s say theoretically it went to 48 cents that would be about a $20 increase in taxes for the average taxpayer.”

Hudson said he prides himself on being transparent with constituents, something he thinks more government officials should prioritize.

“In the interest of full disclosure, it looks to me like we’re going to have to raise it several cents to help close that gap,” he said.

The average taxpayer in Smyrna pays $940 in town property taxes annually, Hudson said.

It’s ultimately the town council’s decision on what number to raise the taxes too, but once they do, the tax raise will go into effect immediately.

It is likely to appear on the council’s meeting agenda until it is resolved, Hudson said, and the next meeting is Tuesday, Jan. 16 at 7 p.m.

Residents can attend the meeting in-person at 27 South Market Street Plaza in Smyrna, or watch it virtually by clicking on the meeting link listed at the top of the agenda, which has yet to be posted but will be posted in the coming days here.

Raised in Doylestown, Pennsylvania, Jarek earned a B.A. in journalism and a B.A. in political science from Temple University in 2021. After running CNN’s Michael Smerconish’s YouTube channel, Jarek became a reporter for the Bucks County Herald before joining Delaware LIVE News.

Jarek can be reached by email at [email protected] or by phone at (215) 450-9982. Follow him on Twitter @jarekrutz

Share this Post