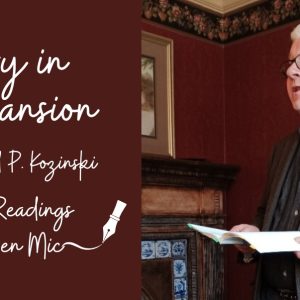

Councilman George Smiley speaks during the July 22 New Castle County Finance Committee meeting amid mounting public criticism over the reassessment process.

Concerns about New Castle County’s property reassessment continue to spark public outrage, as residents took to public comments at the most recent Finance Committee meeting on Tuesday.

The meeting followed a series of discussions at recent county and city meetings, as officials across Wilmington and New Castle County attempt to manage the fallout from the first full property reassessment in over 40 years, conducted by contractor Tyler Technologies.

READ: New Castle County releases new property tax rates amid reassessment review and appeals

Council President Monique Williams-Johns promised that the Finance Committee would provide residents with a platform to be heard. On Tuesday, they took that opportunity.

Many speakers called for a full audit of Tyler Technologies and questioned how the reassessment process could produce such inconsistent results.

“I just looked at Tyler’s assessment values of (five) properties that are exactly the same size as my house in terms of square footage, and those (five) units are all assessed lower than mine,” said Jeffrey Manning, a resident of Meridian Crossing. “I’m almost $50,000 more assessed value than the lowest priced one.”

Brendan Fletcher, speaking on behalf of the HOMES Campaign, made clear that the problem extends beyond technical issues.

“This is about more than tax codes. It’s about racial and economic justice,” Fletcher said. “Working class residents, particularly in Black and Brown neighborhoods, are being overtaxed, while commercial and corporate landowners are being let off the hook.”

Fletcher called for an independent audit and highlighted the broader housing crisis.

“Our city is becoming less affordable from every direction, and our leaders have failed to meet the moment.”

Real estate investors and landlords, including Omar Joseph, said the abrupt changes are destabilizing Wilmington’s rental market.

“This meeting should have been done months ago. Now it’s a little too late,” Joseph said. “What they’re doing is kicking tenants out, they’re raising rents, and or they’re selling and they’re going to other municipalities.”

RELATED STORY: Residents protest after Council rejects rent stabilization in narrow vote

Council blames state and courts, while taxpayers shoulder the burden

While residents asked who was benefiting and who was being punished, some County Councilmembers continued to shift blame elsewhere.

Councilman George Smiley, who co-chairs the Finance Committee, has repeatedly emphasized that the reassessment was court-ordered — not council-driven. At Tuesday’s meeting, he went further, suggesting fault lies with other layers of government.

“Perhaps the attorney should have went to Chancery Court and argued for all of us, because we did what the courts ordered us to do,” Smiley said, referring to the county’s legal obligations.

He also made a point to clarify that, unlike some claims online, taxes are due September 30, not August 1.

Smiley has also previously pointed fingers at Wilmington officials and state legislators for their role in shaping tax policy, saying “the reason that 10% increase went on is because of state code.”

But for residents facing double or even triple tax bills, that kind of deflection is exactly what they’ve grown tired of.

“They’re not going to eat it,” said Omar Joseph, who manages dozens of Wilmington rental units. “They are kicking tenants out, they’re raising rents, and or they’re selling and going to other municipalities, and it’s because of the negligence of New Castle County not doing a reassessment for 30-plus years.”

Homeowners question fairness as commercial properties see reduced assessments

Residents said the reassessment exposed a double standard, with working families paying more while corporations saw their taxes drop.

“I am deeply concerned that at this moment in history… we have a Democratic—a blue—county, New Castle County, not doing enough to make sure that we will not continue to rob from the poor and middle class,” said Mike Matthews, a Red Clay educator.

“At my school board meeting just a few weeks ago, a few properties were named, a few properties who had their taxes dramatically reduced. These are millionaire and billionaire corporations that are having their taxes reduced,” Matthews said. “Does a landlord have the ability to pay a lower rate if they can’t fill their apartment? Are these rules equal across property types?”

Matthews, like others, called for an audit of “the largest commercial, most valuable properties in the state, in the county.”

Several speakers said they would have filed appeals had they known how much more favorable the treatment of high-value commercial parcels would be compared to their own homes.

“What I didn’t think was going to happen—and maybe where I would have appealed—is if I knew that millionaire and billionaire corporations were going to be getting tax cuts,” Matthews said.

RELATED STORIES:

Claudia is a Philadelphia-based journalist and reporter passionate about storytelling that informs and engages the community. Claudia, a proud Temple University graduate, has built a career covering impactful stories and creating compelling content across digital and print media platforms. With a strong background in writing, editing, and research, Claudia has worked on various topics, from local news to in-depth features, always striving to deliver meaningful and accurate reporting.

Share this Post