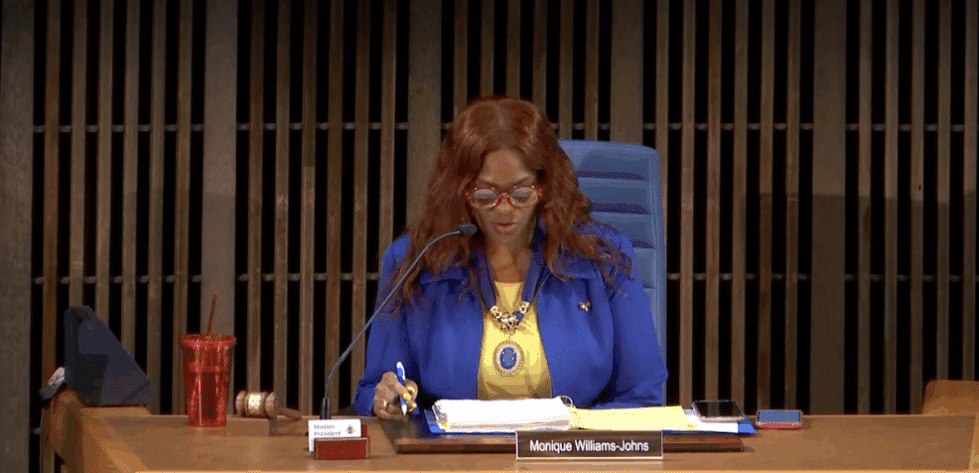

New Castle County Council President Monique Williams-Johns during the Aug. 5 council meeting on proposed property tax relief.

In the latest development in New Castle County’s ongoing property tax reassessment debates, County Council on Tuesday considered Ordinance 25-099, which would authorize installment payment plans for eligible residential taxpayers facing increased bills and allow the Chief Financial Officer to waive penalties for those who comply.

The ordinance, sponsored by Councilman George Smiley, proposes amending Chapter 14 of the New Castle County Code to give the CFO authority to abate penalties for homeowners participating in a payment plan due to higher tax liability following the county-wide property reassessment.

Council members emphasized that the measure applies only to the county portion of tax bills, not school taxes or municipal taxes.

RELATED STORY: New Castle County Councilmembers call for independent audit of property reassessment

Acting Chief Financial Officer Dave Del Grande explained how the plan will work. Taxpayers in good standing may pay their county tax bill in three equal installments due September 30, December 31, and March 31.

If all payments are made, “all penalty and interest would be wiped from the account related to this year’s tax bill,” Del Grande said.

He also confirmed that missing a payment would disqualify the taxpayer and trigger standard penalties.

RELATED STORY: New Castle residents blast county over tax hikes, corporate breaks, and lack of accountability

“They would no longer be on a payment arrangement, so penalties and interest would be accumulated,” he said.

Full implementation details are still being worked out.

Residents say three payments aren’t enough

Several residents who spoke during public comment said the payment plan doesn’t go far enough.

“Three installment plans—otherwise the penalties and all this is accruing—that’s not going to work. That’s going to put houses, people’s houses, up for lien and possible displacements,” said resident Rochelle Wilson during the public comment portion of the meeting.

RELATED STORY: New Castle County releases new property tax rates amid reassessment review and appeals

Vanessa Erding, a homeowner in the Bear Village area, shared similar concerns.

“The payment plan will not be sufficient for low-income homeowners such as myself,” she told Council.

While others called the proposal “disrespectful,” another resident questioned whether mixed-use properties would be eligible for the plan at all.

As councilmembers acknowledged the community’s continued frustration and the complexity of the reassessment process, they urged residents to remain engaged and reach out with questions or concerns.

“We ask you to continue to be patient. I know this is a trying time, and I know because of things that are happening, bills are coming through- but we are asking you to be patient,” said Council President Monique Williams-Johns.

RELATED STORIES:

Claudia is a Philadelphia-based journalist and reporter passionate about storytelling that informs and engages the community. Claudia, a proud Temple University graduate, has built a career covering impactful stories and creating compelling content across digital and print media platforms. With a strong background in writing, editing, and research, Claudia has worked on various topics, from local news to in-depth features, always striving to deliver meaningful and accurate reporting.

Share this Post