Delaware’s revenues appear to be at the same level for 2025 as they are for 24, but the state will have higher expenses to budget for.

Delaware budget forecasts show that revenues and expenditures for 2025 are running at almost the same level as this year, which had a budget of $6.1 billion.

Even so, Dover politicians may have to scramble to figure out how to accommodate an additional $400 million in expenses for 2025.

That’s what Cerron Cade, director of the state Office of Budget and Management, said he expected would need to be added to the state budget.

It will be needed to cover expected hikes in Medicaid needs, salaries for state employees, particularly those in education, and hikes in higher healthcare costs for employees and retirees, among other things.

That information led Monday to a couple of brief discussions from members of the Delaware Economic and Finance Advisory Council about whether Delaware — which relies on income tax, corporate taxes and real estate tax for the majority of its budget — would ever consider raising income tax rates or instituting a sales tax.

The council has no authority to suggest or support a tax or tax hike.

Delaware’s budget years run from July 1 to June 30, and the state currently is in the middle of fiscal year 2024.

If needs outstrip revenue, the state has several funds — $316.4 million in its Rainy Day fund and $402.6 million in its Budget Stabilization Fund — that could be accessed for help.

That money came in handy in 2020 when the COVID-19 pandemic messed with the state’s proposed budget.

DEFAC has been warning for more than a year that the heady days of nearly $1 billion surpluses for 2022, 2023 and 2024, would end this year.

The surpluses were a result of COVID money plowed into the state, unexpected but massive real estate transfer taxes and a rise in corporate taxes and capital gain taxes.

The money allowed Delaware to rebuild its emergency funds. start new programs that are now included in every state budget, and invest $100 million into the massively underfunded account that pays for state retiree benefits such as healthcare.

Now a new state law requires the state to put 1% of the previous year’s General Fund operating budgets into the OPEB fund, which in fiscal year 2025 will be $56 million.

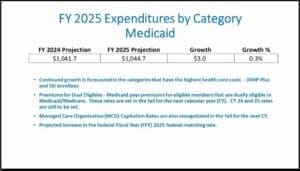

This DEFAC slide summed up some of the issues with rising expenses that will hit Delaware’s budget next year.

Medicaid budget expenses

One of the state’s biggest financial concerns is Medicaid.

It required an additional tens of millions last year as the federal government stopped paying for a pandemic program that allowed the state to increase its roles without checking whether or not people qualified.

But, when the feds stopped paying for those people, the state was only allowed to reduce the number of people on the program by 10% a month, but still had to pay for the rest.

DEFAC members noted that the number of people on Medicaid in September — about 305,882 — is 27% of the population and no lower than it was last year, but much higher than the 205,000 in March 2020 before the pandemic began.

The state is continuing to roll people off the program, said Josette Manning, secretary of the Delaware Department of Health and Social Services, but they are not the high-cost members of Medicaid.

The aging population is, she said. Their numbers are growing, as are policies and rules that increase spending for them, she said. Two examples: The state pays for the Medicare costs for people who don’t have the resources, and policy changes have meant more money goes to nursing homes, she said.

RELATED STORY: Wilmington Council members protest mayor removing city residency requirement for employees

So the roll-off means nothing financially, one member of the council asked.

“If I heard you correctly, it’s a combination of those who remain are the most expensive, combined with a series of … state legislative initiatives that have increased the population or expanded the care for those who are in the population,” he asked.

Yes, Manning said, and pointed out that some of the policies have been retroactive.

“Essentially, with the unwinding, you are not going to see some giant financial impact by those folks being rolled off because of all of the other things happening at the same time,” Manning said.

DEFAC chairman Mike Houghton, a Wilmington lawyer, asked aloud how the embedded costs in state expenditures were going to be met if they continue to rise.

The state can reduce some expenses and may, “for all the right reasons,” expand initiatives and coverage for others, he said.

But tax revenues are not rising, he noted.

“Where are we going to get the money for that?” he asked. “I see tax increases out on the horizon, and somebody’s going to have to deal with that. I know nobody’s going to address that and deal with that this year .. but there will be a day of reckoning.”

DEFAC will meet again Dec. 18 at the CSC Station on the Riverfront. The meeting is livestreamed, but the link is not yet posted.

Betsy Price is a Wilmington freelance writer who has 40 years of experience, including 15 at The News Journal in Delaware.

Share this Post