Residents of Caesar Rodney School District seem to be divided on April 22’s tax referendum that would increase school property taxes by 27.7%, or about $200 a year on average.

The district says the money is needed to help pay for utilities, maintenance, building budgets and staffing.

“No way I want my taxes to go up,” said 74-year old Sharon Barilla.

She doesn’t have any children or grandchildren in the district, so she said the increased revenue for the district would not benefit her at all.

Kris Roeske, a 34-year old resident of Camden, said he and his wife Laura support the tax increase because they have little children who will later enter schooling, potentially in Caesar Rodney schools.

“If they have outdated facilities and that sort of thing, I wouldn’t be against an extra few hundred a year to help maintain the buildings that our kids are at,” he said.

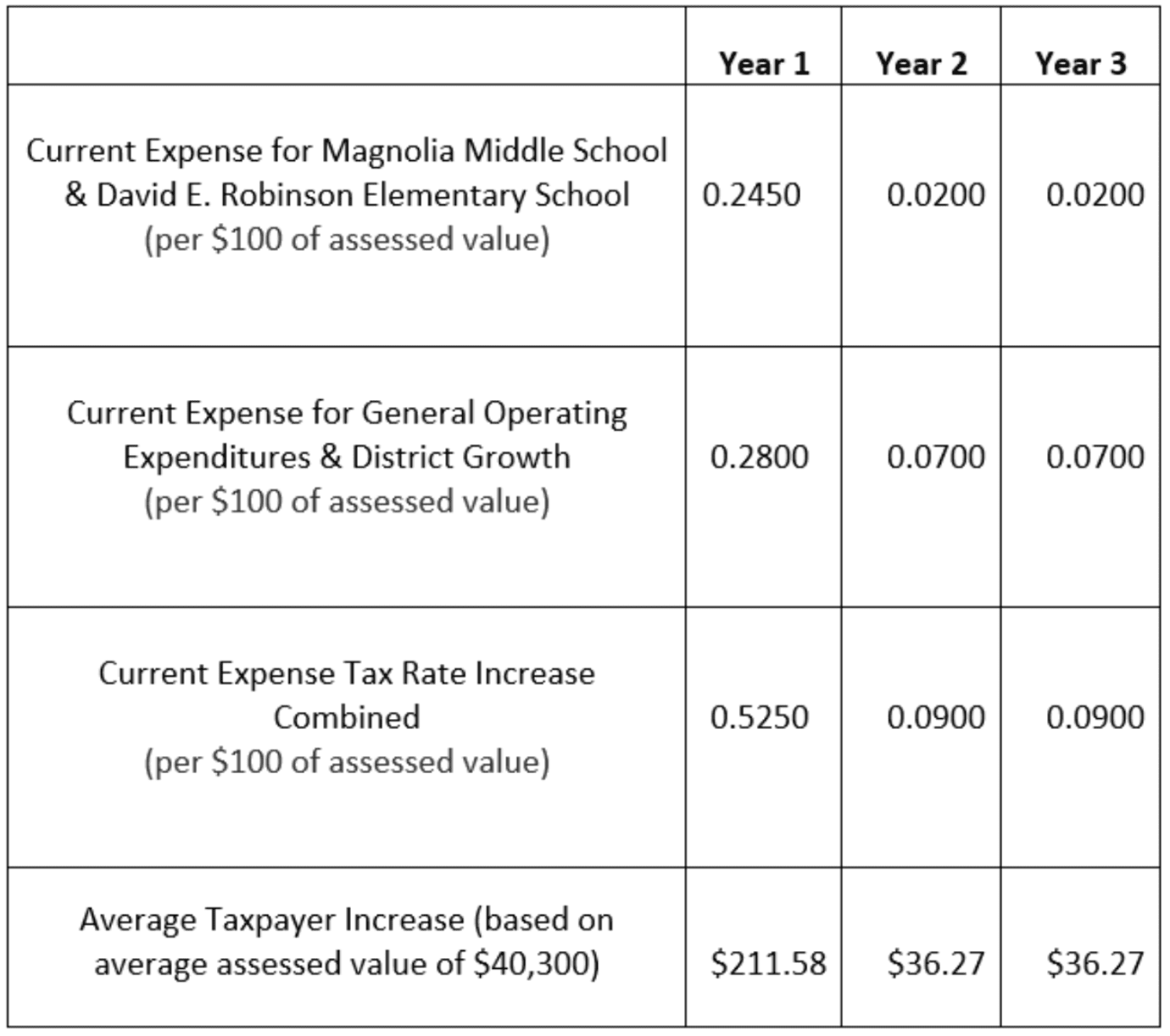

The average taxpayer, who owns a house with an assessed value of $40,300, would have their taxes increased by $211.58 in 2024 and another $36.11 in 2025 and 2026, said Caesar Rodney Superintendent Christine Alois.

RELATED: Caesar Rodney wants to raise school taxes 27.7%

Alois said the district’s expenses are outpacing its revenue since its growth in enrollment in recent years.

Caesar Rodney has grown to 8,290 students, 324 more than it had in 2021.

It must raise taxes to receive an $11,037,200 state Certificate of Necessity grant. Under the terms of that grant, the district has to raise $4,508,152 to match the state contribution for a total of $15,545,352 to help the district with its identified needs.

Woodrow Gravenor, 77, is against the tax hikes. He said schools need to improve on disciplining their students and making sure parents are actively engaged with what their children are being taught.

“There’s transparency issues, and we need to solve that and discipline before giving them more money,” he said.

Dee Fields, a 54-year-old resident of Wyoming, said she plans to vote yes on the ballot.

“I just think it’s really needed,” she said, “For all the growth that we’ve had coming in, and you know, the schools are overcrowded, and I think it’s good and we need to do it for our youth.”

A referendum allows residents of a school district, through a ballot process, to vote to approve or reject changes to the district operating expense tax and debt service tax.

The district’s school board triggered the vote when it unanimously approved the referendum in its Feb. 28 meeting.

43-year-old Heather, who declined to give her last name because her husband works for the state, said she’s voting no because she doesn’t want a bump in her taxes.

A resident of Camden, she has children in Caesar Rodney schools, but said that doesn’t sway her because she thinks the district’s schools need to do better with what they have.

“They’re not hiring new teachers,” she said. “When they start hiring and actually showing that they’re making the effort, then they’ll get my money and support.”

The ballot will include three questions: one for updating the heating, ventilation and air conditioning system at Magnolia Middle School; one for operating expenses for David Robinson Elementary and Magnolia Middle; and one for general operating expenditures related to district growth and its 2022-2027 Strategic Plan.

Voting for the heating, ventilation and air conditioning project will not increase taxes at all, Alois said, since the district already has the money to complete it.

Voting for operating expenses for the David Robinson and Magnolia schools would increase tax rates by 0.245 cents next school year, 0.02 cents in 2024-2025 and 0.02 cents in 2025-2026 for each $100 of assessed home value, Alois said.

Voting for general operating expenditures related to district growth would have an increase in tax rates of 0.28 cents in next school year, 0.09 cents in 2024-2025 and 0.09 cents in 2025-2026 – again, per $100 of assessed home value.

Proposed tax hike for Caesar Rodney residents:

If the vote fails, the district can hold another referendum.

“We appreciate our community’s consideration of all three questions on the ballot,” Alois said.

Voting will take place on Saturday, April 22, from 7 a.m. to 8 p.m.

Voting locations include Allen Frear Elementary School, W. Reily Brown Elementary School, Fred Fifer III Middle School and J. Ralph McIlvaine Early Childhood Center.

Raised in Doylestown, Pennsylvania, Jarek earned a B.A. in journalism and a B.A. in political science from Temple University in 2021. After running CNN’s Michael Smerconish’s YouTube channel, Jarek became a reporter for the Bucks County Herald before joining Delaware LIVE News.

Jarek can be reached by email at [email protected] or by phone at (215) 450-9982. Follow him on Twitter @jarekrutz

Share this Post